Reserve Bank boss impressed by student questions

Reserve Bank boss impressed by questioning on economy

Reserve Bank Governor Philip Lowe described questions from students as professional level when he made his third visit to Trinity as part of the School’s popular Economics Q & A series.

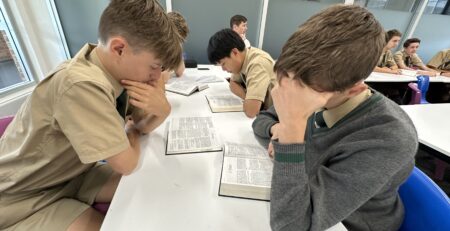

Dr Lowe was grilled on issues ranging from cryptocurrency, housing bubbles and budgets to depressions, negative interest rates and currency wars when he spoke with Year 12 students.

“The questions were fantastic, often better than the ones I get from the press,” he said.

“I was impressed with the way they were delivered; the boys showed confidence and enthusiasm, made eye contact and were able to articulate their ideas very well.

“They showed a deep appreciation of current issues. They were either well prepared or well read; I suspect both.”

Dr Lowe is the fourth RBA Governor to take part in Head of Economics Ian Moore’s topical sessions over the past 30 years, joining a long list of luminaries including five prime ministers, four premiers, three treasurers, two treasury secretaries, ambassadors, judges, academics, business leaders and journalists.

Trinity students kept Dr Lowe on his toes with a range of penetrating questions. Here is a sample:

Nixon M: My granddad is a 73-year-old with a SMSF (self managed super fund). The real estate and equities markets look interesting to him but the bubble is a worry. Putting money into a bank account won’t go very far. If you were my granddad where would you put your money?

Antony Z: For three years all I’ve heard from Mr Moore is that cryptocurrency is the greatest con since the Tulip Bulb bubble of the 1880s. At the same time, the price of Bitcoin has gone up 1,000 per cent. Are you in Mr Moore’s camp that cryptocurrency is a bubble that will burst?

Perry C: Governors of central banks around the world have been engaged in currency wars in order to stimulate economic growth. Has the RBA been tempted to be involved in a currency war action?

Jamie C: Given that long time lags exist around monetary policy, shouldn’t actions (to handle a surge in house prices and inflation) start today?

Jamie C: Does $1 trillion of public debt concern you?

Andrew C: Do you believe the dispute between China and Australia could be the catalyst for war?

Dr Lowe’s replies are not publicly reported here in order to facilitate a more free-flowing exchange with students.

He was, however presented with $5 from his last visit for winning Mr Moore’s prediction game, rating future economic indicators such as the ASX and $A at year’s end.

“He has always been spot on,” Mr Moore said.

“That’s $10 he has got off me, although at current (low) interest rates it doesn’t really matter!”

Previous Q & A guests at Trinity have included Prime Ministers John Howard, Paul Keating, Tony Abbott, Bob Hawke and Malcolm Fraser, Treasury secretaries John Stone and John Fraser, NSW Premiers John Fahey, Michael Baird and Bob Carr, federal Treasurers Peter Costello and Ralph Willis, and RBA governors Bernie Fraser and Glenn Stevens.

Others to front the students have included media figures Alan Jones, Kerry O’Brien and Ross Gittins, business leaders Gerry Harvey, John McGrath and Chris Corrigan, and ACTU secretary Bill Kelty.

Mr Moore said the programme provided students with increasing confidence and exposed them first hand to the “inter-personal skills which these dignitaries display”.

“Many guests have flown from interstate for these sessions. Some enrolled their boys at Trinity after their visit. Others have offered work experience for students.

“Two students from our class of 2008 now work in research at the Reserve Bank.

“I am indebted to our gifted guests. They have made better Australian citizens out of our students.